Benchmarking Performance Using Financial Ratios

How well is your organization performing? The answer depends on what you are measuring performance against and the financial performance metrics you are using. What’s the target? Are you above par, or below? Most businesses set targets on at least an annual basis, but external events beyond management’s control drive a great deal of variability. That was certainly the case in 2020 as the coronavirus pandemic upended virtually everything. Under normal circumstances, the world is not as volatile as that, but fluctuating prices, competitive pressures, variability in demand, and other factors still come into play.

The simple question “How well are we performing?” can quickly become a subject of much debate. Business leaders who define rigid targets risk passing judgment on decisions and managers that don’t adequately reflect the reality at street level. Those who make generous allowances, on the other hand, fail to adequately instill accountability within their organizations. Defining success and failure is notoriously difficult, and trying to quantify and qualify it within dynamic organizations isn’t any easier.

Financial ratios provide a good starting point for defining performance metrics, though, because they generally incorporate broad swaths of data into a single, easily understood metric. Certain ratios bring the realities of enterprise performance into stark relief, and benchmarking how those ratios change from month to month makes performance measures explicit and easily discernible, both the good and the bad.

Leveraging Financial Ratios for Sustained Success

There are dozens, potentially even hundreds of different ratios to track, each with a unique insight to offer. To avoid the consequences of analysis paralysis, decision-makers should focus on the financial ratios that provide the clearest, most comprehensive summaries of financial strength and business performance. Here are a few potential starting points:

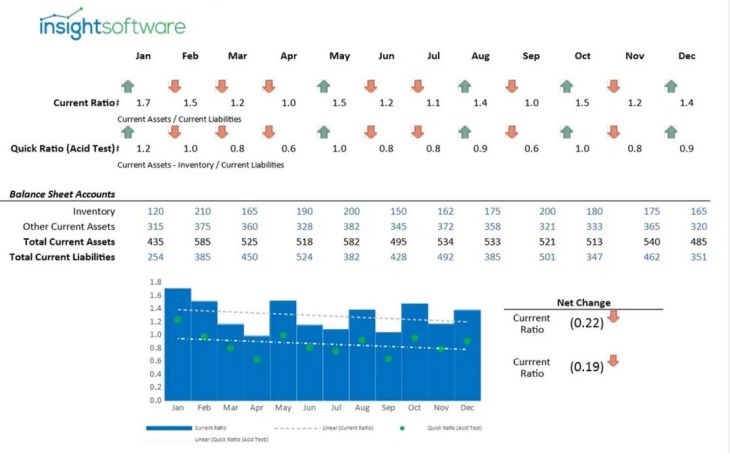

Liquidity measures an organization’s ability to meet its current debt obligations. Your business may be running smoothly, and your product might be selling like hotcakes, but if you can’t keep up with your loan payments, then sooner or later your business will hit the wall. The most common financial metrics associated with liquidity are the current ratio and quick ratio. Both measure the ratio of current assets to current liabilities. In other words, if all of your debts were to come due suddenly, would you be able to pay?

The primary difference between the two measures has to do with the timeframe they address. The current ratio includes any assets that you can convert to cash within a year, whereas the quick ratio focuses on the very near term. It excludes inventory and only looks at assets that you can convert to cash within 90 days. An ideal current ratio is around two. The ideal quick ratio is one or slightly higher.

Common measures of profitability include return on equity and gross profit margin. Return on equity (ROE) assesses the efficiency at which shareholders’ equity is being used. It is an extremely important metric for CFOs and investors, who use ROE to assess the financial performance of an organization relative to its peers within the same industry.

Gross profit margin measures the margin as a percentage of total sales. In other words, it subtracts the cost of goods sold (COGS) from gross sales revenue, then divides the result by gross sales revenue. Operating margin takes a somewhat broader view of the business by including all operating expenses in the margin calculation. To determine the operating margin, divide operating income by total revenue. In this case, you subtract all operating expenses from the numerator, rather than just COGS.

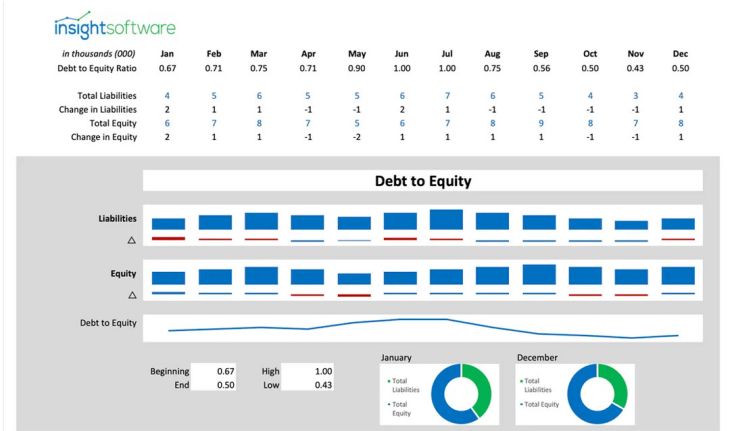

Leverage ratios indicate the level of debt and debt covenant that a business has incurred relative to other accounts on the organization’s balance sheet, income statement, or cash flow statement. The most common leverage ratios are debt to equity and debt to assets. Calculate debt to equity by dividing total debt by total equity. Debt to assets, likewise, is a simple matter of dividing those two numbers to come up with the correct ratio.

Efficiency ratios indicate the productivity of working capital. In other words, how effective is the company at generating additional value from its existing assets? Common metrics include inventory turnover, asset turnover, and receivables turnover. Inventory turnover is usually calculated on the cost basis of the inventory rather than selling price. To calculate it, divide the COGS by the average inventory on hand. For consistency, you should convert the turnover rate to an annualized number. Otherwise, a comparison of monthly vs. quarterly vs. annual turnover rates would be skewed by the shorter or longer time periods over which you calculated them.

Asset turnover measures the efficiency with which a company can generate value from its assets as a whole. Calculate it by dividing total revenues by total assets. As in the case with the previous metric, you should convert the asset turnover rate to an annualized number for consistency in drawing comparisons over time.

Receivables turnover measures the effectiveness of a company in collecting money owed from credit sales. To calculate receivables turnover, divide net credit sales by average accounts receivable. Once again, make appropriate adjustments to annualize the results for comparison over multiple periods of time.

Although this is far from being a comprehensive list, it should provide a good starting point for companies that wish to align managers around a common set of KPIs. Benchmarking financial ratios across these four categories (liquidity, profitability, leverage, and efficiency) shines a light on the most important workings within a company. Monitoring specific vital signs shows companies exactly when something starts trending downward and precisely where attention and resources are most needed. In that way, financial ratios enable companies to manage their own performance closely, carefully, and comprehensively.

Using ratios for benchmarking is not a new concept. Companies have known for some time that these metrics have value; they simply lacked a good way to track them closely. Thanks to advances in financial reporting, however, tracking metrics isn’t just easier now–it’s almost effortless.

Managing Performance through Financial Reporting

For many, financial reporting is a slow and labor-intensive process. Unfortunately, many of the most popular ERP and accounting software systems do not set out to provide these kinds of metrics out of the box. In fact, developing meaningful reports often requires a substantial commitment of IT resources, or it relies on a tedious and error-prone process of manually manipulating exported data, pasting them into spreadsheets, and adding formulas.

For companies with a purpose-built financial reporting solution, though, automation handles the hard work of collecting, integrating, and updating data. Perhaps just as importantly, a robust reporting product can query data in real time, providing information that is always accurate and up to date.

Consider the example of a report that shows the current ratio for the previous twelve months. In a traditional manual process, you might manage the report in an Excel spreadsheet using data that you key in by hand on a monthly basis. If there is ever a data entry error, the numbers will be incorrect. Likewise, if any of the numbers have changed (for example, if you make adjusting entries to a prior accounting period), then the numbers will also be wrong. The person managing this report will need to periodically review the numbers from the previous 12 months, make sure they are correct, and fix any numbers that might have changed.

Unfortunately, that scenario is all too common in many companies. It often results in numbers that are out of sync, such that the P&L, balance sheet, and KPI dashboard don’t always reflect the same results. Those kinds of inconsistencies undermine confidence in the numbers and often leave the management team arguing about which number is correct.

With automated financial reporting in place, you can avoid those kinds of issues completely. Decision-makers have access to the latest performance figures at all times, without having to retrieve them manually. With access to the very best information available, transparency increases, trust in the numbers rises, and outcomes improve. The evidence is right there in the next round of financial ratios.

Understanding the relationship between data, reporting, and enterprise performance is an extensive topic. At insightsoftware, it’s what we focus on every day. Our experts have created an extensive library of resources to help business leaders explore these topics at length. One such resource is our Financial Ratios Dashboard. It’s free to download and use, and it can help you better understand where your organization is today with respect to some of the key metrics that can provide greater focus and direction for your business.

The Financial Ratios Dashboard can help you learn more about which ratios are most meaningful for your business and how to calculate them. When you download the dashboard, you’ll also learn how dynamic dashboards can bring financial ratios to life, helping you to align key leaders throughout your organization around the KPIs that matter most.

We encourage you to read through the dashboard to learn more about the financial ratios you need to track and how to adapt your financial reporting accordingly. Get our Financial Ratios dashboard template and customize it with your own data today.