Top Five Financial KPIs for Property Management Firms

What distinguishes a successful property management firm from all the others? It’s not their portfolio of properties. In fact, the truly elite firms are the ones that find ways to transcend their portfolio, capitalizing on the value of whatever they handle. They do that through careful financial management.

Every firm balances the books, of course, but some treat accounting and finance like more than a routine obligation. They see the opportunities of tracking financial performance as closely as possible, and the perils of doing anything less.

These firms leverage a deep, insightful understanding of their own financial strengths and weaknesses to make the best decisions in all instances. In the process, they insulate themselves from disruptions while growing their business around sound financial decision-making rather than risky bets.

Tracking financial performance takes more than commitment. In fact, the process often goes off the rails when a firm tracks too many different financial indicators because they end up with more data than they can analyze. Financial tracking (meaning giving a subject close, constant attention) requires firms to focus only on critical metrics like these:

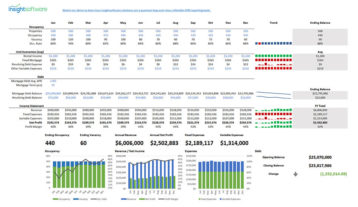

1 – Revenue Growth

In property management, it’s easy to get bogged down in the details and lose sight of what really matters—a steadily increasing bottom line. This metric is at the top of the list because it speaks to the fundamentals of financial performance. If revenue growth is flat or falling, it suggests the firm is falling short of its core objectives. Alternately, if the rate is growing faster than normal, it points to successes that deserve to be studied and repeated. Any change in revenue growth, upward or downward, needs to be on the radar and checked regularly.

2 – Outstanding Debt

In the same way that revenue can trend downward without anyone noticing, debt can creep upward if no one’s paying attention. Carrying too much debt causes cash flow to dry up and makes it harder to achieve profitability targets, so decision makers can’t take their eyes off this issue. In addition to tracking the ups and downs of debt, financial decision makers at the firm should analyze debt levels in the context of other financial performance metrics. Done regularly, this helps decision makers anticipate when debt could become an issue or when opportunities exist to responsibly take on more debt.

3 – Rental Costs

How much does it cost on average to rent each unit under management? Some firms track just the costs of doing cleaning and repairs between tenants, others include the cost of marketing the vacant unit as well. Because rental costs relate directly to the profitability of each unit, firms need to track them closely and take notice when costs start to rise.

4 – Net Income

Property rentals may drive revenue without being the sole source. Many firms also operate coin-op washers, generate fees from storage units, or charge extra for parking spaces. It’s easy to take these supplemental sources of revenue for granted, but it’s risky to assume they’re stable. Tracking net income, including rent and all other sources, gives firms a more holistic view of their financial performance.

5 – Occupancy Rates

The core of the property management business is finding and keeping tenants, so it’s no surprise that the occupancy rate makes the list of important KPIs. Firms must understand how many of their units are occupied compared with other buildings or neighborhoods in their market to preserve or build on their competitive advantage. Related to that, decision makers need to know the instant occupancy rates change in any way.