Why Rolling Forecasts Are a “Must”!

In periods of great uncertainty, organizations forecast more frequently in the hope that it will give them a better handle on their trading prospects, levels of activity, and resources needed for the coming months. But cranking the handle more often doesn’t necessarily lead to richer or more accurate insights.

At FSN, we call it the “hamster wheel” effect. The forecasting wheel is turning faster and faster, but the process hasn’t changed materially. Smart CFOs know that there is a world of difference between continuous planning and doing things differently.

Rolling forecasts provide the basis for continuous reappraisal of performance in the light of changed circumstances. In effect, a rolling forecast is a sliding 12-month (sometimes more) window of performance. As a new month is added to the forecast, the oldest month drops off. So, unlike the traditional budget, it’s a technique that looks beyond the limitations of the financial year. For example, in the last quarter of the year, a 12-month rolling forecast will be looking forward 9 months beyond the year-end. So, rolling forecasts are inherently much more forward looking than the traditional budget.

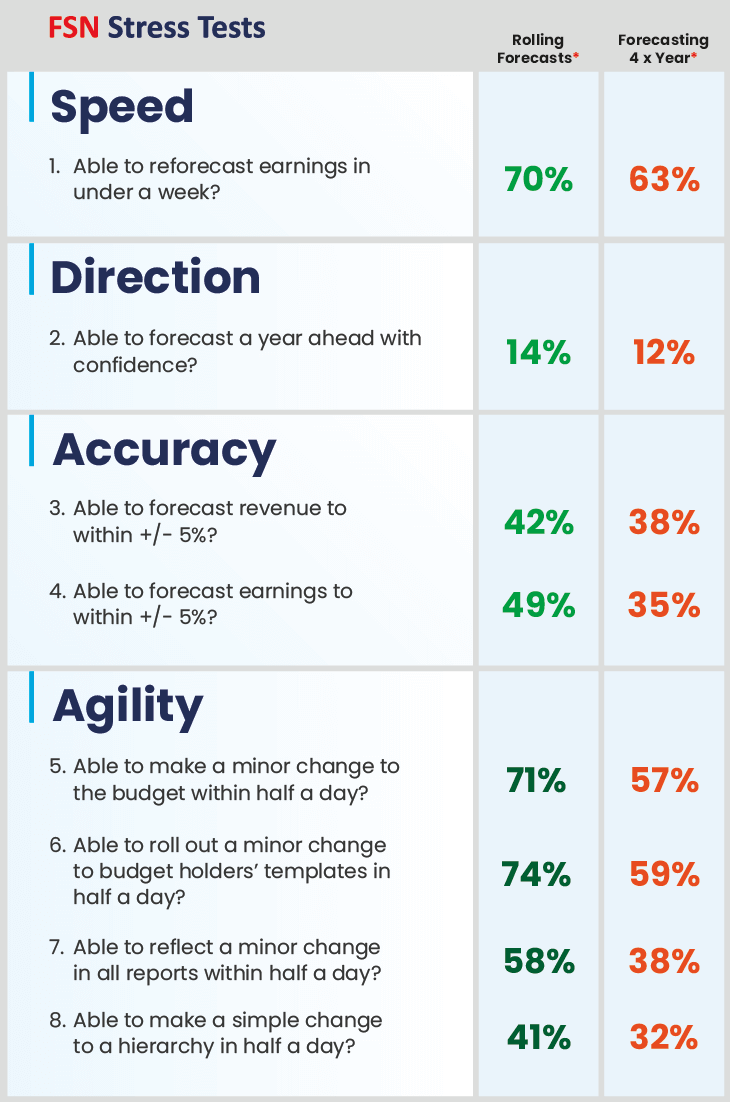

FSN’s 2021 research, “Agility in Planning, Budgeting, and Forecasting” confirms the profound benefits of this technique. As one would expect, those using a more automated 12 month rolling forecast are able to reforecast quicker. Seventy percent are able to reforecast in under a week versus 63 percent who only reforecast quarterly. And there is a small but significant improvement in the number of organizations that can forecast a year ahead (14 percent versus 12 percent).

Rolling forecasts also improve accuracy. Almost half of rolling forecasters are accurate to within plus or minus 5 percent of earnings, versus 35 percent of those that forecast four times a year, and there is an improvement in revenue forecasting as well, although slightly less marked – 42 percent versus 38 percent.

While there is a notable improvement in speed and accuracy amongst organizations that use rolling forecasts, the progress is even more profound within the context of organizational change. Those using rolling forecasts are able to make changes far more quickly and easily when circumstances require.

For example, 71 percent can get a minor change, such as a cost line added or taken out of a budget or forecast model within half a day, versus 57 percent who are bound to quarterly forecasts. There is similar disparity in getting changes added to budget holders’ data entry templates – 58 percent of those using rolling forecasts are able to get the above change reflected in all reports within half a day, whereas only 38 percent of quarterly reforecasters can do it within the same timeframe. Finally, 41 percent can make a simple change to their reporting hierarchies in half a day compared with 32 percent of the quarterly re-forecasters.

Table 1. Comparison of the performance of organizations using rolling forecasts and those reforecasting four times a year.

*The table shows the percentage of organizations that satisfied each stress test.

Rolling forecasters outperform the quarterly forecasters in every category (see Table 1 above), but despite the profound advantages, uptake has been relatively slow and sparse. Only 19 percent of organizations have moved to rolling forecasts.

This year’s FSN research shines a light on why uptake has been so low. Around three quarters of organizations are heavily reliant on standalone spreadsheets, but these are not up to the job. Rolling forecasts need a dependable, centralized repository of data and the financial intelligence (periodicity, automatic period roll-over, multi-dimensionality, calculation support) of specialized planning, budgeting, and forecasting solutions. These things are not easily replicated in a spreadsheet.

Rolling forecasts are the way forward for more speedy, accurate, and forward-looking forecasts, but businesses will need to get their data in order first and invest in specialized tools if they are to make any real strides.