As organizations face uncertainty in the wake of the global health crisis, many are seeking unique ways to understand the new dynamics of the economic landscape and monitor their recovery process. One strategy getting a lot of attention is the integration of alternative data sources to gain an information advantage over the competition, particularly when it comes to investment decisions in the finance sector.

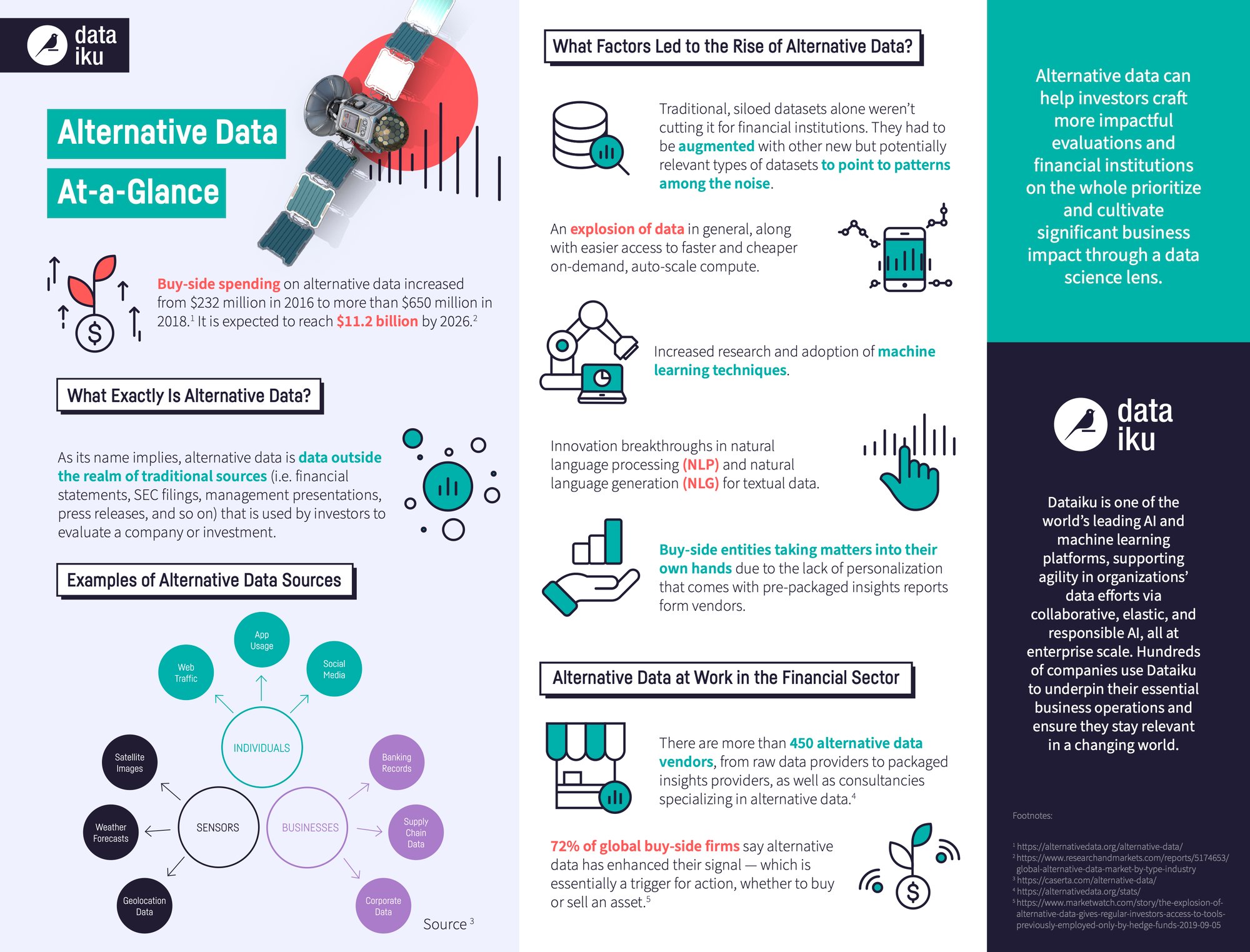

This infographic explains the key types of alternative data, reasons behind its rapid growth, and why it is set to disrupt investment management over the next few years.