Three Ways Transfer Pricing Teams Can Find and Address Variances in Targeted Profitability

The extreme market volatility over the past 12 months has likely led to organizations grappling with KPIs that are continuously off track from the forecasts in their financial and tax plans.

This is especially true for multinational entities with subsidiaries spread across the world – all of which are likely experiencing different levels of market turmoil, changing government support programs, and shifting tax regimes.

Transfer pricing teams have been in a unique position throughout all this turmoil. Because they operate closely with the tax teams and financial planners, transfer pricing professionals fulfil a pivotal role in striking a harmonious balance between government tax regimes and business operations set within chaotic markets. Their main goal, after all, is to help the business hit the tax team’s effective tax rate (ETR) forecasts, but turbulent market conditions are making that process more difficult than it was in calmer times.

When so many variables are in flux, it’s the transfer pricing team’s job to notice whenever a subsidiary is off course and in danger of failing to hit its forecasted ETR. Whenever a subsidiary goes off track, transfer pricing teams must work with the tax professionals and financial planners to determine what must change: the forecasted ETR, the financial plans, and/or the actual prices charged by the business. Companies that do not regularly check their profitability actuals against target forecasts often find variances when it’s too late. In time, small variances can snowball into much larger gaps that become more difficult to remedy at year-end. Although large, retroactive adjustments can technically be made, there is an increasing chance that they trigger time-consuming and expensive audits by tax authorities.

So how can transfer pricing teams better find and address variances during these unprecedented times? In our view, there are three main ways: identify red flags as early as possible; increase the visibility of data sources used for forecasting; and coordinate more proactively with the finance and tax teams when variances are found.

1. Identify red flags through frequent monitoring

Transfer pricing teams should strive to increase the cadence of their monitoring activities, especially given the current environment of market volatility. Ideally, they should check actuals on a quarterly or monthly basis to see how their subsidiaries are tracking in terms of their expected profitability and resulting tax commitments.

More frequent monitoring allows teams to spot variances and take action much earlier on, thereby avoiding larger, drastic variances that can be tougher to fix at the end of the year.

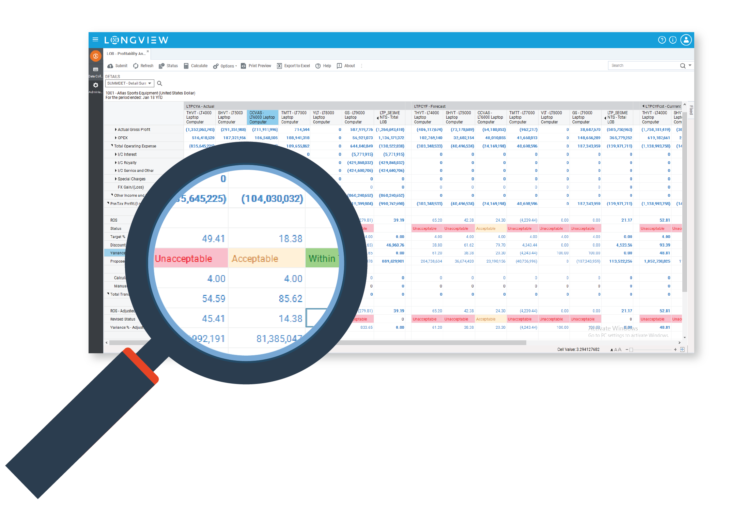

In order to support more frequent monitoring, it’s helpful to have a system that automatically provides monthly consolidated financial data. This allows teams to quickly monitor if that month’s actuals and resulting profitability (or loss) is on target with what was expected. In this way, the full portfolio of subsidiaries can be tracked against the overall forecasted tax liability the company will have for the year.

Slight variances are natural, but they should nevertheless be noted so that any larger trends are closely followed and proactively addressed much earlier than during the year-end close.

2. Increase data visibility

As well as monitoring performance more frequently, transfer pricing teams should seek to operate with as much detail in the finance data as possible. Top transfer pricing teams make it a priority to work with fully-burdened P&L reports that can be broken down by jurisdiction, entity, timeframe, and even by line of business in some cases.

Visibility of this data allows operational transfer pricing teams to not only identify when a subsidiary is off track, but to more easily determine the main rate drivers. The availability of detailed finance data makes it possible to go way beyond simply noting if an entity is tracking 10% under its forecasts for the year, for example. Instead, teams are able to dig much deeper into the background information and work out what is causing the unexpected 10% dip in profitability. Once these variables are known, it becomes very easy to take corrective measures.

Comparing data points from previous years is a helpful way when conducting variance analysis to find those rate drivers before taking action. By comparing past performance with current P&Ls, teams can work out whether any issue, such as a 10% dip in profitability, has come about as a result of lower transaction volumes, lower purchase amounts, higher costs, or any other details that may be contributing to the trends. Government loans and credits, or other debts, are particularly important to consider in the current environment. Having a clear picture of how these elements will impact profit or loss moving forward adds to the richness of high quality analyses.

Above all, building the greatest visibility possible means that operational transfer pricing teams can be as well-informed and confident as they can be before sharing their analysis with business unit heads and finance.

3. Take coordinated action with business units and finance

Once the transfer pricing team finishes its analysis into what may be happening with any given variance, it can reach out to the finance team to determine if the financial projections for the year are still attainable. Given the large variances in question, it’s important to figure out if the projections need to be revised, or if simple pricing revisions would be enough to still hit the existing forecasts. .

At the same time, the transfer pricing team can also work with the business unit heads of affected subsidiaries to get their perspective on what’s happening operationally. This helps to paint a clearer picture of the market and operational drivers that could be causing the variances. Strong communication undoubtedly helps the transfer pricing team to proactively run scenarios that model potential price changes for that particular entity, and how those changes will cascade throughout the supply chain if enacted.

Adopting a data-driven approach with as much context built in as possible helps to establish a level playing field for these cross-team discussions: business units, along with finance, tax and transfer pricing teams, can access the same single version of the truth. This facilitates effective collaboration to find the best way forward for all parties.

Operational transfer pricing software

Strong operational transfer pricing has become a must-have requirement due to its profound usefulness in today’s market volatility. In short, specialized transfer pricing software fulfils roles that can no longer be realistically achieved using manual or semi-manual processes, even if systematized spreadsheets are employed. Today, the ability of an operational transfer pricing team to carry out frequent monitoring, maintain deep visibility into the finance data, and take coordinated action with other teams absolutely requires the support of dedicates software.

Operational transfer pricing software is built from the ground up to improve organizations’ visibility into the performance of all their related entities and subsidiaries throughout the year. At any point, transfer pricing teams know exactly how each company is tracking toward its profitability goals.

Most importantly, thanks to these solutions, analyses are conducted more frequently throughout the year and action is taken to bring finances back on track, instead of reconciliations being undertaken at year-end. This leads to variances being smoothed out much earlier and increased confidence in the numbers across the board.

Although it’s difficult for anyone to foresee what lies ahead these next few years, chances are that it will not be ‘business as usual’. There has never been a better time to introduce your business to the benefits of monitoring, data visibility, and coordinated action regarding your transfer pricing.

To discover how insightsoftware’s Longview Transfer Pricing matches up against your requirements, request a demo.