How to Achieve a Stress-Free, Streamlined Year-End Close

If you work in finance and accounting, a lot of things in your life are probably put on hold at certain times of the year. For most, the annual year-end closing process is one of the more stressful times on the annual calendar. Management wants those final numbers as soon as possible.

That means gathering information from a wide variety of sources, checking and re-checking the numbers. Then you have to validate balances against external sources, and pull it all together to create a complete picture of your organization’s financial health. Deadlines loom, and for a few weeks (or an entire month) everything else gets put on hold.

The good news is that it doesn’t have to be that way. There are some proven methods for increasing accuracy, while decreasing the overall workload associated with period-end closings.

Year-End Challenges

Ultimately, year-end processes are about gathering information, validating it, and organizing it so that it tells an accurate story about your business. Most organizations, however, must grapple with many different sources of information. At the very least, you must validate external information such as cash balances and loans payable against the general ledger, but many organizations must also summarize and reconcile information from different software systems.

For an organization that is running specialized billing software in addition to core ERP, for example, that creates some challenges. Year-end account reconciliations must often include data points from more than one system. Bringing those together into a single report usually means copying and pasting (or manually rekeying) data from those many different systems, usually into Microsoft Excel.

For businesses with many subsidiaries or business units, each with its own financial system, those challenges get much more complicated. First, there is the question of presenting data from multiple systems in a way that is easy to analyze and digest. Intercompany balances must be validated and closing entries calculated.

Then there is the challenge of presenting that information in consolidated financial statements. When you have finally recorded all of the intercompany entries and eliminations, you must present general ledger data in consolidated form, in addition to displaying separately for each subsidiary. Reporting that information in many different formats quickly becomes unwieldy.

It’s not uncommon for numbers to be out of sync across those multiple financial statements. That raises questions from management and erodes confidence in the reported results. It takes a disciplined approach to bring order to all that chaos and produce financial statements that are clear, consistent, and accurate.

To add to the difficulty of the period close, many organizations struggle with a shortage of trained staff to work on year-end closing processes. These tasks typically require keen problem-solving abilities; they can’t easily be delegated to inexperienced staff.

This, combined with the inherent time pressure associated with year-end closing, places a significant burden on the finance and accounting team.

Traditional Tools Fall Short

For most organizations, the built-in reporting tools that come with their core financial management systems are inadequate to support effective, efficient year-end close processes. Those tools are incapable of handling data from many financial systems and/or external software packages designed for specialized billing, inventory management, or fixed assets, for example.

Sophisticated business intelligence tools, on the other hand, are great for analyzing trends, tracking key performance indicators, and monitoring the pulse of the business, but they tend to be poorly suited to the kind of methodical, detailed analysis required for period closing tasks.

That leaves most businesses resorting to the default option—copying from stock reports or data exports and pasting that information into Microsoft Excel. That can be a tedious process, especially when your team is constantly updating the information within your source system. Every time there is a change, you are forced to repeat the tedious copy/paste process.

On top of that, the copy/paste method often results in errors. If someone pastes data into the wrong cell, or if the source report contains more rows (or fewer rows) than it used to, it’s easy to introduce errors into the resulting analysis in Excel.

Create Automated, Accurate, Repeatable Processes

For a stress-free, streamlined year-end close process, you should look to implement automated, accurate, and repeatable processes. Tools that enable you with direct access to information from multiple systems, in real time, are the fastest and most effective way of automating many of those tedious year-end closing tasks.

Assume, for example, that your period closing process includes a reconciliation of A/R balances from an external billing system to the general ledger. With a manual process, someone would need to run reports from both systems, enter (or copy and paste) those numbers into Excel, and create a worksheet as backup for the final numbers.

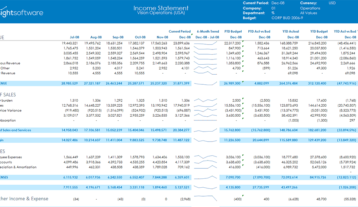

Now consider what that process might look like with automated tools. The financial analyst creates an Excel spreadsheet template, including live links to the source data in both the general ledger and the separate billing system. To automate the process further, the analyst adds formulas to check for matching numbers and highlight exceptions. Now it’s simply a matter of refreshing data from those source systems to create an up-to-date worksheet for the year-end close. The process that used to take hours can now be completed in a few minutes. Then, every time someone makes a change in your source system, you can refresh your reports immediately with the latest data. No more copy and paste. Now you can see instantly if your numbers balance or if you need to investigate any variances.

That kind of automation is possible with products from insightsoftware that enable a financial analyst to link directly to real-time data from multiple source systems, including over 140 different ERP systems, specialized industry-specific software packages, and more.

Now Is the Time to Prepare for Year-End Closing

Consider how different the year-end closing process could be with automation and real-time reporting in your organization. What if your end-of-year close could happen in one or two days instead of in a month? What if next year’s budgets and forecasts were already seeded with valid data, and you didn’t have to start from scratch? A better year-end close could mean time and money saved on audit prep, and higher confidence in the data you deliver.

Watch this on-demand webinar on how to Accelerate your monthly, quarterly, and year-end reporting and learn how to:

- Improve visibility into reconciliations

- Accelerate report pack production

- Shrink your budgeting and forecast cycle

- Find a solution that delivers real-time reporting directly from your ERP

See how a great year-end close can lead to less money spent on audits, faster year-end reporting, higher confidence in numbers, and continuous processes that deliver better financial data throughout the year.