How to Streamline Regulatory Reporting in the Finance and Banking Industry

The volume of regulations and the scale of ongoing regulatory compliance legislation often leave finance teams struggling to meet new reporting requirements. Finance and banking regulatory costs have been forecasted to rise from 4 percent to 10 percent of revenue by 2021. This translates into frequent modifications to accounting and reporting processes to meet ever-changing regulatory reporting requirements.

Stop-Gap Measures Are Not Enough

Finance teams are already overwhelmed with regulatory reports such as 10Ks and 10Qs, changes of ownership stock transactions, call and thrift reports, FFIEC reports, and more. The changing nature of the regulatory landscape frequently leaves them scrambling to gather data in whatever format is available, often via manual inputs to Excel. This leaves little time for data analysis and is where data accuracy suffers, potentially resulting in non-compliance and fines.

It has been estimated that 89 percent of firms believe that regulations are not only increasing costs for their organizations, but that compliance spend could more than double over coming years. As an example, banks paid an excess of $42 billion in fees for non-compliance infractions in 2016, and one New York bank was ordered to pay fines of $185M for failing to comply with rules intended to protect client assets in 2015.

Key Attributes of an Effective Regulatory Reporting Solution

Finance teams need to streamline their data management and reporting to keep up with the pace of change in state, federal, and global regulations. Large financial and banking institutions have entities across the globe, subject to multiple geographic regulations. They often have various reporting tools in use for different categories of transactions such as return on equity, specific fund performance, loans, deposits, and more.

In order to meet the challenge of regulatory reporting requirements, finance teams need a solution that can do the following:

- Integrate accounting and financial data and consolidate it across financial statements

- Standardize processes and reporting across multiple systems and reporting tools

- Ensure data analysis procedures are followed correctly and consistently

- Enable organizations to keep up with new regulatory and industry policy changes

- Implement a regulatory strategy with automated reporting, eliminating manual processes for custom, repeatable report creation

- Manage multicurrency functions, multiple books, advanced allocations, financial planning, built-in security, rebates, taxes, asset management

- Analyze trends in the daily business activity

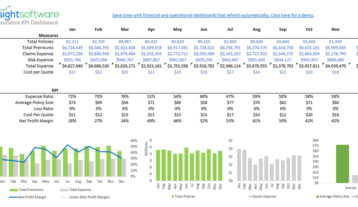

KPIs and Regulatory Reporting

Finance and banking institution KPIs often include attributes tracked for regulatory reporting. Those same attributes of a reporting tool that are desirable for regulatory reporting can also help finance teams evaluate the KPIs. For example, the FFIEC Call Report must be filed by banks in the US on a quarterly basis. It includes income statement, loan and deposit information, changes in the bank’s capital, and several other sections respective to the institution’s viability.

Many of these are KPIs already tracked by the regulated entity. The FDIC oversees compliance with filing requirements and stringently audits the Call Report for errors and audit flags. The right analysis and reporting tool can help finance teams track KPIs for internal performance monitoring and enable accurate regulatory reporting.

Some KPIs that go hand-in-hand with regulatory filing requirements are:

- Return on Equity: The ratio of net income to shareholders equity. A high return on equity ratio is preferable, as it means that the institution can use the invested funds wisely and is able to generate more returns.

- Loan to Deposit Ratio: The ratio of investment of a bank to its depositors. This liquidity ratio determines the short time viability of the lending functions. A low loan to deposit ratio indicates that the bank is not viable in the short run and would likely result in an audit flag from the FDIC.

- Capital Ratio: A ratio to determine general efficiency and profitability, which determines the solvency of the bank. A bank should have a capital ratio of 7 percent or more. The minimum regulatory requirement is 4.5 percent.

- Return on Assets: The ratio of net income to total assets. This ratio not only shows profitability, but also indicates the viability of the institution in the long run.

All finance team members who touch KPI monitoring or the regulatory reporting process can benefit from self-service reporting to create the custom reports they need without involving IT. Optimizing regulatory reporting requires a reach across all systems to gather the appropriate data and correlate it automatically into prebuilt report templates to streamline the reporting process.

Information needs to be effectively shared throughout an organization with reports in consumable formats tailored to the specific audience. This gives finance more time for analysis and helps them meet critical reporting deadlines with accurate data. Empowered with the right tools, finance can achieve accurate, repeatable regulatory reporting and adapt as requirements change.

insightsoftware reporting helps finance teams easily perform reporting and in-depth data analysis to support accurate regulatory reporting. See it in action by requesting your free demo today.

Industry challenges from financial reporting in banking and finance make reporting in this arena specifically challenging. View our infographic to learn how financial software is positively impacting financial reporting for banks and financial services.