In June 2018 Martin Lewis, the U.K. money-saving expert, sat on the This Morning breakfast show sofa and explained how the new Open Banking regulations would herald a revolution in retail banking. He explained how banks will now need to share data, not only enabling customers to more easily move their money to those providers that deliver the best value, but also providing banks with the means to provide better financial support. Lewis gave the example of how banks would be able to advise on utility bills and cost of living. Unfortunately, given today’s financial challenges , the reality turned out to be not quite as rosy as Lewis’ vision.

The Real World of Banking Customers

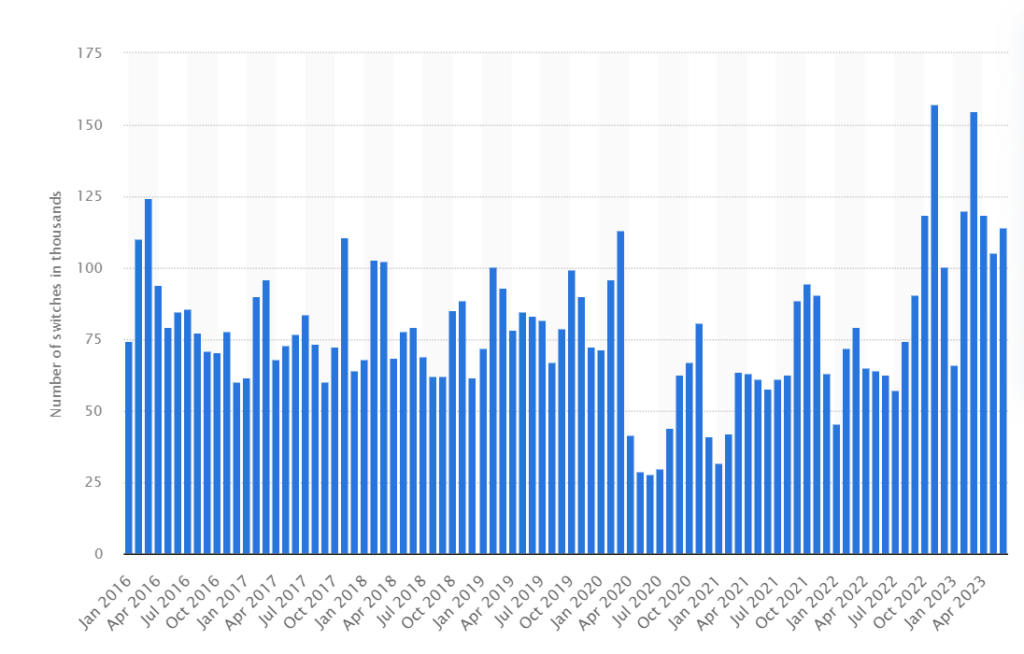

The graphic below, from Statista, shows no discernable change in customer mobility since January 2016. So, since the introduction of Open Banking, the retail banking revolution, and the imagined account mobility, has clearly not happened. Why might that be? Why was Martin Lewis wrong?

The number of customers switching their current bank account providers in the U.K. from January 2016 to June 2023:

Source: https://www.statista.com/statistics/417397/number-of-switching-current-bank-accounts-uk/

The Structure of Traditional Banks

The reason lies in how banks are structured. The traditional high street banks have lines-of-business covering mortgages, current accounts, loans, insurance, etc., supported by central functions such as risk and credit. Each of these divisions also have their own infrastructure and data which, over time, has grown significantly. If you consider an average mortgage lifespan to be 25 years, you can imagine the amount of data held over, say, a 35-year period.

These organizational silos, with their huge data repositories, find it almost impossible to collaborate, especially when you factor in the need for real-time decision making. As a result, banks cannot quickly establish a customer’s relationship with the bank in terms of products held, length of relationship, debit/credit positions etc. This also makes it very difficult to provide any meaningful insight into spend by category, i.e., utilities, mortgage, savings, entertainment, etc., across multiple accounts and/or products. This therefore makes it impossible for customers to access their financial data from other financial institutions. If banks cannot get a unified view of their customers’ financial position from their own sources, then adding yet more sources delivers no real value. Banks find it almost impossible to provide the level of financial insight and services that Martin Lewis described in his interview. This is also why we are not presented with personalized products, i.e., a mortgage with built-in insurance and interest offset by savings.

A Seamless Solution

However, there is an answer to these technical challenges. These large data silos can be unified by approaching the problem logically rather than physically. Rather than trying to consolidate large volumes of data into yet another large repository, create an abstraction layer above the physical systems and work within a logical framework. The Denodo Platform is a logical data management platform that enables enterprises to access any data source and query the data in real time, without having to replicate – or move – any data.

Not only are there operational gains to be achieved by a bank, such as migrating from legacy systems, moving to the cloud, or consolidating data sources, but banks will be able to create data models that would support real-time analysis of spend, particularly when a customer opts into Open Banking. This in turn would mean that banks would be able to offer the kind of insight into financial affairs that could help us manage the cost of living and enable banks to offer personalized products at a time when they are most needed.

To summarize, we should be demanding that our banks address those technical challenges, begin to offer a more personalized service with truly beneficial insight to our financial activity, and provide the guidance that Lewis was suggesting back in 2018.