Why Finance Teams are Struggling with Efficiency in 2023

The results are in–for the third year in a row, insightsoftware has partnered with Hanover Research to deliver our yearly Finance Team Trends Report. Comparing results across the years shows an incredible journey for finance teams across the globe. The survey included 519 senior accounting and finance professionals across North America and Europe, the Middle East, and Africa (EMEA). 52% are located in North America while 48% are in EMEA.

What are the top strengths, challenges, and areas of improvement for finance decision-makers in 2023? Here, we discuss the top trends for finance teams this year.

External Market Challenges are Hampering Finance Teams

In 2023, the impact of external factors is clear as the optimism from the previous year has been replaced by pragmatism and realism. Although organizations have largely recovered from the COVID-19 pandemic, they’re bracing themselves for a potential recession.

External market challenges including economic disruption, skills shortages, and rising interest rates, are squeezing efficiency from one side. And on the other, internal pressures like the need for more frequent, accurate forecasting force CFOs to re-evaluate their existing tools and processes.

The Impact of Market Uncertainty

This year, Finance decision-makers are feeling pressure from both internal and external sources. Nearly three-quarters (70%) of this year’s survey respondents feel pressure from inflation, economic disruption, and recession. These factors create a demand for finance professionals to be more efficient.

Gartner describes recent global economic pressures as a “triple squeeze,” which includes:

Inflation and high interest rates

- Companies looking to refinance a loan or coming out of a five-year fixed rate are suddenly looking at interest rates that are significantly higher than they were previously paying.

A tight labor market

- There’s a notable skills gap due to loss of existing talent, driving the need to do more with less. Many organizations have set digitization goals but lack the tech talent to push through their transformation.

Supply chain constraints

- Unpredictable supply chains in recent years have necessitated keeping a closer eye on business fundamentals while highlighting the importance of staying ahead of inventory management.

This year’s survey results echo this. The top external factors impacting finance team efficiency were:

- Economic disruption (48%)

- Interest rates (42%)

- Skills shortages (41%)

As a direct result of the COVID-19 pandemic, organizations have adapted to expect the unexpected from the global market. It’s been a vital skill to keep businesses afloat. According to the International Monetary Fund’s World Economic Outlook, global inflation soared to 8.8% last year with no signs of slowing down–a return to a steady interest rate isn’t expected until 2025.

In addition to this economic squeeze, skills shortages are still a key challenge. This year’s survey highlighted a significant drop in teams expecting to grow in 2023 down to 64%, compared to 73% in 2022.

Spreadsheet Server Tips & Tricks: Visualise Your Report Data in Power BI

Download NowChanging Global Regulations

Compliance-related finance responsibilities, like tax management, present a notable challenge, especially during a landscape where regulations are constantly shifting. Respondents highlighted a greatly reduced perception of efficiency related to tax management, with only 68% of teams rating their processes as efficient, compared to 84% last year.

With the first filing deadlines for Base Erosion and Profit Shifting (BEPS) Pillar Two looming on the horizon, the learning curve grows even steeper. The regulation requires any organization that operates in more than one country to pay a minimum effective tax rate of 15% in any nation where they do business. For finance teams struggling with tax management, it’s vital to evaluate their current systems to determine whether they’re prepared to comply with new and upcoming requirements.

Internal Pressure Continues to Rise

Hampered by native or legacy tools that are too complex to support the increased demands for custom analysis, finance teams struggle to keep pace with growing demands on their time.

The top challenges for finance teams in 2023 are:

- Budgetary restraints (32%)

- Raised prices (29%)

- Lack of skills in team (27%)

- Manual and time-consuming processes (24%)

- Data limitations and inaccuracies (24%)

Lack of Autonomy and IT Over-Reliance

One quarter (24%) of finance teams still find “manual and time-consuming processes” to be a key challenge. Disconnected systems and manual, spreadsheet-based processes are incredibly cumbersome for Finance teams. And manual processes increase the likelihood of reporting mistakes. With heightened scrutiny on organizations and leaders, organizations can’t afford such a high risk of error.

What complicates matters are what the results reveal about the relationship between Finance and IT. In 2023, Finance decision-makers are less likely than 2022 to be completely satisfied with the relationship between Finance and IT, decreasing from 54% to 28%. And 66% of finance professionals find they’re too reliant on IT.

The Result? Efficiency Drops Across the Board

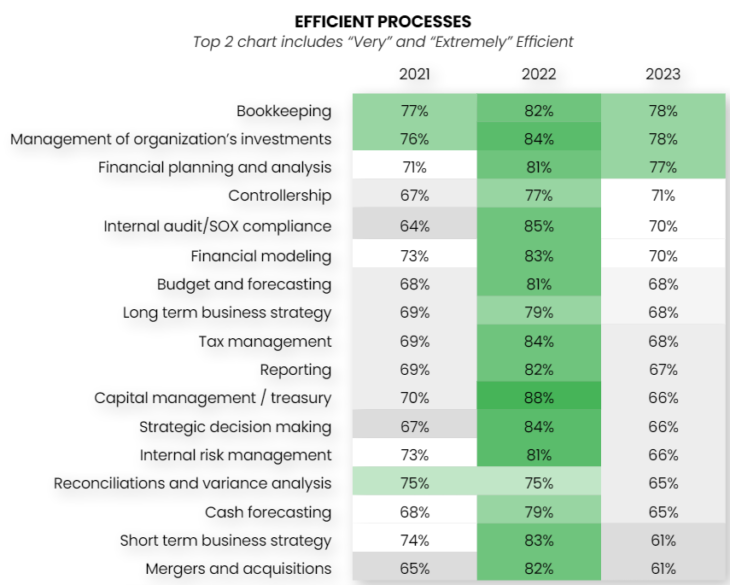

The impact of internal and external pressures on finance team efficiency is clear. In 2023, teams are less efficient at 100% of responsibilities tracked, compared to 2022 results. It’s impossible to correlate this result with any one factor. However, it’s clear that the combination of internal and external pressures has resulted in teams having less resources to complete the same amount of work as they’ve had in recent years.

When you compare 2023 and 2022 results, the biggest efficiency drops are seen across:

- Capital management / treasury: -22%

- Short term business strategy: -22%

- Mergers and acquisitions: -21%

- Strategic decision making: -18%

- Tax management: -16%

Surprisingly, Finance Still Prioritizing Hiring

Due to market factors, priorities for finance teams have changed dramatically over the past year. Top priorities for 2023 are:

- Prioritizing balancing growth with profit effectively (31%)

- Increasing productivity of existing teams (30%)

- Hiring and staffing (29%)

Teams are focusing on balancing staff levels and increasing their productivity, but efficiency challenges indicate a missing step between where organizations are now and where they want to be in terms of streamlining repetitive workflows and dedicating time to focus on future planning. Adopting new technology can help bridge those gaps, but it doesn’t rank high on finance teams’ priorities. In fact, there has been a decrease in the priority of task automation from 40% in 2022 to 25% in 2023.

Struggling With Skills Shortages? Why Self-Service Reporting Eases the Pain of Staffing Constraints

Download NowHow Are Finance Teams Bridging the Efficiency Gap?

Impacted by external factors like market disruption and skills shortages, organizations are prioritizing squeezing more value from existing, tight resources. At the same time, companies are inspired to work smarter by increasing efficiency to fill in staffing and skills gaps.

Due to external factors, organizations are:

- Reducing budgets (47%)

- Cutting costs (45%)

- Executing tasks with fewer people (38%)

To alleviate efficiency gaps, organizations are working to “right-size”– after the loss of experienced employees in 2021, organizations hired new workers in 2022, then adjusted in 2023. Despite efforts to train existing workers and encourage collaboration, finance teams in 2023 are about 4-5% less efficient than they were last year. The highest efficiencies are bookkeeping (78%), management of organization’s investments (78%), and financial planning and analysis (77%).

Smooth Sailing Through Uncertain Times

Investing in automation tools can help ease the pain of skills shortages and repetitive tasks. For example, interactive, real-time, refreshable reporting technology can save time on repetitive tasks and increase efficiency within your organization.

With the help of intuitive technology, new staff can also be trained faster while relieving understaffed departments. insightsoftware’s connected solutions help finance teams reduce planning, reporting, and close cycles by 50%, improve data quality and accuracy, enhance visibility and collaboration, and drive better business outcomes with:

- Budgeting and Planning

- Financial Reporting

- Close & Consolidation

- Operational Reporting

- Disclosure Management

- Tax and Transfer Pricing

Factors from market uncertainty to skills shortages and over-reliance on IT are taking a heavy toll on finance teams in 2023. Although organizations are making the most of what they have, efficiency still suffers. As finance teams focus on helping drive business strategy, an investment in technology ensures organizations can take control of budgeting, planning, and reporting while still having time for value-added analysis. To learn more about a suite of solutions that can improve efficiency at your organization, visit insightsoftware.com.