Three Benefits of Shifting Your FP&A Focus from Resource Allocation to Life Cycle Management

Traditionally, business planning happens on a fairly predictable cadence. The annual budgeting process tends to be a fairly intensive undertaking. Sales forecasts lay out expected revenue, department heads pull together their wish lists for the coming year, and finance brings it all together into a cohesive structure, after which the negotiation process can begin.

That’s generally a lot of work, particularly if your business is still relying upon manual processes to extract the prior years’ numbers from the ERP system, copying and pasting that into Excel spreadsheets, perhaps merging in some sales pipeline numbers from CRM, and then building out all of the spreadsheet formulas needed to assemble your budget. Then there is the process of passing all of that information back and forth, keeping track of edits, and eventually merging it into a single cohesive budget.

Fortunately, technology has made it possible to automate many of those steps, as well as provide a framework for collaboration with budgeting and planning workflows. As that kind of software has evolved, many business leaders are revisiting the traditional approach to budgeting and planning. They are extending the process further out into the organization, soliciting deeper and more meaningful input from a wider audience of stakeholders. They are moving away from rigid annual budget cycles to the more flexible approach of continuous planning. They are shifting away from “managing the status quo” toward a more agile and responsive budgeting and planning methodology.

The arrival of the COVID pandemic in early 2020 was a wake-up call for many executives. It underscored the need for rapid access to accurate information and the ability to adjust quickly to unexpected changes in the business environment. This mandate for agile business planning, combined with the availability of robust financial planning and analysis tools, has prompted widespread interest in new approaches to the budgeting and planning process.

It’s Not Just About Volatility

Although the pandemic has certainly been a catalyst for this shift, there are plenty of other reasons why it makes sense to shift away from a more rigid annual budgeting process toward continuous planning.

Annual budgeting tends to focus on adjustments to the status quo. That is not to say it doesn’t allow for new initiatives and aggressive growth plans, but the traditional approach does tend to produce budgets that are, in many ways, simply an extrapolation of the prior year’s numbers. A great many businesses have turned to zero-based budgeting for this reason, because it calls for a fresh look at every line item. It requires that departmental leads justify all planned expenditures.

Organizations also tend to orient annual budgeting toward the short term. It aligns resources with expected results within a specific timeframe, such that looking beyond the horizon (that is, the end of the coming fiscal year) does not effectively serve the interests of department heads seeking higher budgets. An annual planning process generally demands that managers justify proposed expenditures based on promised results within the same budget year.

Just as the executives of many publicly traded companies complain that the investment and finance industry demands short-term results, the annual budgeting process tends to have the same kind of effect on department heads within a business, albeit on a smaller scale and with a bit more room for adjustment.

Nevertheless, the annual budgeting approach tends to overlook the fact that many successful business initiatives span the end of the fiscal year, or even across multiple years. In fact, business opportunities frequently emerge midway through the fiscal year, long after you have completed the annual planning process.

Consider the case of manufacturing firms that saw an opportunity in the spring of 2020 to produce personal protective equipment (PPE), which was in very high demand at the time. Launching a major new initiative like that certainly was not in the cards when company leaders finalized the budget months earlier. External conditions called for an abrupt change of direction that was never envisioned in the original plan. Although that may sound like an extreme example, the fact remains that annual budgeting does not easily lend itself to seizing upon new opportunities quickly when they appear.

How can you adjust the process to accommodate these factors? One increasingly popular approach is life cycle planning.

What is Life Cycle Planning?

Life cycle planning takes a different approach than traditional planning and budgeting. Instead of using fixed time periods (such as fiscal years) as a primary frame of reference, the life cycle approach views budgeting from the perspective of products, services, and programs from the time you initially conceive them to the point at which you retire them or they otherwise reach their conclusion.

Just as most businesses require some time before showing a profit, new products and services typically require some initial investment of time, money, and resources. They don’t necessarily show return until further down the road. That process can often take more than a year–or in many cases, even several years.

The life cycle approach recognizes this reality by shifting the emphasis away from short-term ROI based on an arbitrary timeframe (such as the coming fiscal year) and instead calls for a realistic analysis of the entire product (or service, or program) life cycle. Typically, that means an initial start-up period in which expenditures exceed revenues, which is (hopefully) followed by steep increases in revenue, and eventual decline as the product reaches obsolescence, or as competitive pressures from the market force you to change your plans.

This affords managers the freedom to plan with short-term losses in mind while understanding that longer-term positive ROI is a necessary and achievable goal. In many respects, this approach fosters a more holistic view of the business because forecasts are not distorted by false expectations about short-term profitability for any given program.

Whereas traditional budgeting can often be about fighting over the biggest piece of the pie, life cycle planning shifts the attention toward the long-term viability of products, services, and programs. New opportunities dovetail more easily into this approach as well. While they may call for some reallocation of resources (or new sources of capital), they don’t necessarily always demand a re-shuffling of existing resources to justify their existence.

There is at least one key advantage to the traditional annual budgeting process. Aside from the fact that it is the most familiar approach, it is also definitive. When you establish a firm budget at the start of each year, leaders tend to approach any proposed changes with a healthy measure of caution.

Having said that, the life cycle approach to planning and budgeting does have some distinct advantages. Let’s take a look at some of the ways that this shift in focus can be beneficial.

1. Life Cycle Budgeting Takes the Long-Term View

Analytics software giant SAS is one of America’s most successful private companies. When CEO Jim Goodnight is asked why he has never taken the company public, he offers several reasons, but a top concern for him is the pressure on CEOs of publicly held companies to focus on short-term results.

Annual budgets are often oriented around the hoped-for annual results that are (or at least should be) driven by the departments and initiatives receiving funding. In this respect, the traditional approach is really about resource allocation. It is about understanding the costs and benefits of products and programs, then allocating company resources to the ones that show the greatest promise.

While it’s not unheard of to justify current year expenditures based on expected long-term benefits, that is a tough sell in many organizations. Conventional thinking says that it’s far better to justify this year’s expenditures by promising short-term results. This often leads to a situation in which departmental managers (or product managers, or division managers) make inflated claims about the results they expect, often resulting in unrealistic revenue forecasts that conform to the classic “hockey stick” paradigm.

By focusing on product life cycles, managers are freer to apply realistic or best-case/worst-case projections that more closely align with reality.

2. The Life Cycle Approach Allows for Greater Agility

In a business climate in which major changes can happen virtually overnight, business leaders understand the need for agility better than ever before. The arrival of the COVID pandemic on the scene in early 2020 rendered existing budgets virtually meaningless. In many industries, demand dropped precipitously. In others, demand went through the roof. Virtually everyone was scrambling to adjust to their new normal, whether that meant reconfiguring production lines, accommodating new sales channels, or aggressively managing liquidity at a time when credit risk suddenly seemed very high.

Budgeting and planning that focuses on the life cycle of products, services, and programs fit nicely into this new paradigm in which a great deal can change in short order. While COVID provides an especially vivid example (and one with which we are all quite familiar), there are plenty of other cases that illustrate the need for businesses to change direction abruptly. The emergence of a new competitor, for example, or a major regulatory change, new tariffs, disruptions in the supply chain, or the development of a viable new technology can all be disruptive events that call for an immediate response.

As brick-and-mortar traffic plummeted in the age of COVID shutdowns and social distancing, businesses around the world invested heavily in building out e-commerce and fulfillment capabilities. External changes call for a response. In this respect, life cycle planning reflects the way you must do business in a world that demands greater agility and responsiveness.

3. Life Cycle Shifts the Focus from General to Specific

Another shortcoming of the traditional annual budgeting model is a tendency to roll up details into departmental budgets such that you lose visibility to specific products and programs. In other words, you view budgets in terms of the total resources allocated to a department and the overall results produced by that department, rather than gaining a better understanding of the costs and benefits of specific investments.

When you segregate costs and associated revenues by initiative, rather than merely rolling them up to department total, it provides a meaningful opportunity for analysis in which you can align metrics around those initiatives, providing a clearer view as to which activities and investments create the most business value. In other words, the life cycle approach to budgeting prevents the true ROI of the company’s products and activities from getting lost amid the background noise.

Level-Up Your Budgeting Game

Focusing on life cycle offers an intriguing new way to think about budgeting. If your organization is still relying upon manual processes and Microsoft Excel to drive FP&A, the life cycle approach might seem a bit too complex or out of reach. The idea of continuous planning, that is, developing rolling forecasts and making more frequent adjustments throughout the year, might also sound overwhelming.

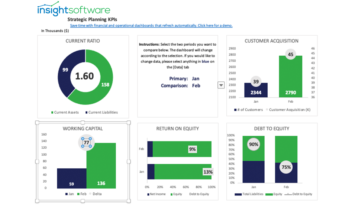

With the right planning and budgeting tools, however, your organization can connect real-time data from your existing systems (such as ERP or CRM) with forecasts and analyses built upon input from stakeholders throughout the organization. Workflows can ensure that tasks and information flow to the right people at the right time, creating a structure for accountability throughout the process. Collaboration tools offer efficient mechanisms for communication among distributed team members, wherever they may be located. Modern FP&A tools help to keep your information secure and available while maintaining proper version control so that everyone in your organization is on the same page.

With FP&A solutions from insightsoftware, your business can increase organizational agility and achieve rapid benefits to the bottom line. To learn more about how you can become an agile organization, download our free guide, Eight Key Factors to Consider when Evaluating Continuous and Extended Financial Planning Software.