Boost Data Literacy to Overcome Skills Shortages

As the world emerges from the recent pandemic, organizations continue to struggle to find solid ground in an uncertain economic climate. Plagued by supply chain disruptions and price inflation, finance teams are at the forefront of organizational efforts to strategize and remain agile in changing circumstances.

Now more than ever, organizational leadership is looking to the Office of the CFO to be a strategic partner in building an overall business strategy. This means finance is saddled with providing timely planning, forecasting, and reporting that informs business decisions in the moment. Resource allocation, however, does not always grow in tandem with those responsibilities, leading to scalability challenges for finance teams tasked with doing more with fewer resources.

When you think about skills shortages, investing in data literacy isn’t the first action that comes to mind. But it should be. Enabling your existing workforce to be more productive with data is key to increasing quality and speed of output. When you consider it from that perspective, it makes sense to invest in optimizing the processes and tools that build data literacy across the organization.

The final state of the data literacy spectrum, “data fluency,” is achieved when your employees have adequate levels of data analysis skill for their needs and are enabled by a robust toolkit that gives them unfettered access to every organizational data source. It is at this intersection of technology and skill that true data insights are generated.

Challenges That Oppose Data Fluency and Efficiency

To scale with growing responsibilities, finance teams must eliminate manual processes to free up time and have tools that enable autonomous analysis of data. A recent insightsoftware study sheds some light on the top challenges for modern finance teams seeking to do more with less:

- Time-consuming Manual Processes. Among those teams facing execution challenges with capital management tasks, 53% listed time-consuming, manual processes as the biggest challenge. For financial planning and analysis and controllership, 50% and 44% said the same, respectively.

- Lack of Resources. Half of teams unable to completely execute financial planning and analysis and controllership listed a lack of resources as a significant problem, and 48% of those struggling with capital management tasks agreed.

- Lack of Skills in Team. Skills were identified as a significant issue for 48% of those struggling with controllership, 42% of teams struggling with financial planning and analysis, and 41% of teams struggling with capital management.

- Inability to Access Required Data. Being unable to readily access the required data for tasks was a big challenge according to 43% of teams working to execute on capital management tasks, 35% of teams working on controllership, and 33% of teams working on financial planning and analysis.

From Data Literacy to Fluency: Strategies for Becoming a Data-Driven Organization

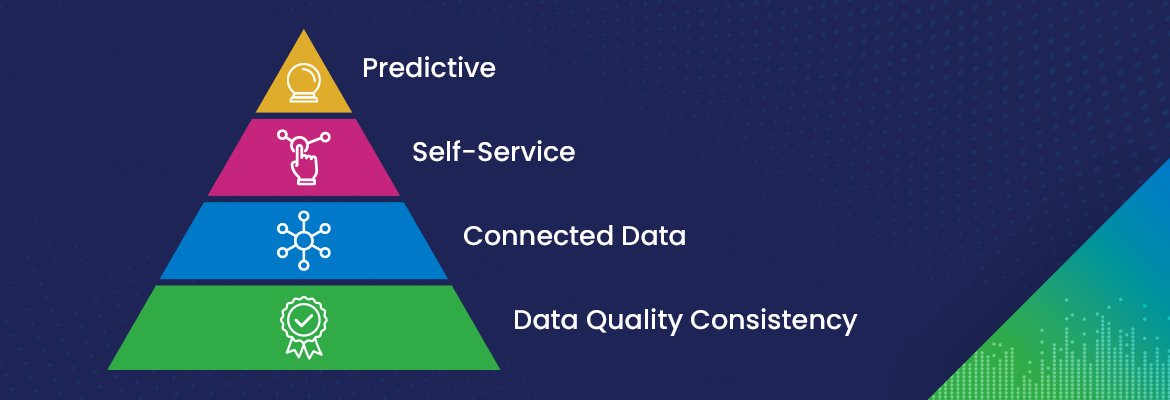

Download NowFour Steps to Achieving Data Fluency

Another recent insightsoftware study, this time on building data fluency, highlights some key steps that organizations can take to shore up data processes and reduce time spent waiting for IT.

Data Quality Consistency

Data quality and consistency is the foundational challenge. Most organizations work from multiple disconnected data sources with unreliable data entry methods. Without confidence in the base data, employees will never reach data fluency. Systems and processes must be carefully considered to ensure data alignment and accuracy.

Connected Data

Next, connected data is essential for users to achieve a wholistic view of the organization. Analysis of data from one system does not give a complete picture. Ironically, many businesses feel like their analysis is hamstrung by the complex array of data systems and tools at their disposal.

Self-Service

Related to this complexity, self-service reporting and analysis emerged as a priority for many organizations. “Self-service” has been a business intelligence buzzword for the last decade but lacks a clear definition. The truth is that self-service is a relative state, depending on the specific needs and skills of your analytics users.

Predictive

Finally, predictive data analysis and forecasting is the capstone to true data fluency, representing true synergy of people, data, and tools. With all the other, more foundational, challenges to work through, predictive analytics unsurprisingly scored lowest on the list of current capabilities. However, predictive analytics and true data synergy should be the end goal for any data-driven organization.

In the quest for efficiency, CFOs must address each of these challenges sequentially. Connected systems are only useful if the data is clean and consistent. Similarly, self-service analysis is at its most useful when you have a clear view of data from across the business and are confident in its accuracy. Accurate forecasting is the final prize of solving these other foundational data literacy challenges.

Skills shortages and reduced resources are major obstacles for finance teams looking to make a splash this year. A short-sighted approach would be to cut salaries and reduce tooling, but the opposite is what’s required. To have any hope of keeping up with economic uncertainty in the years to come, finance must be largely self-reliant, at least for the basic tasks. Following the above steps to boost data literacy will take time and effort, but the results will speak for themselves.