How to Build a Scalable, Agile Financial Technology Stack

The financial world is a volatile place. Regulations are constantly changing, markets are routinely in flux, and monetary units change their value almost every day. In this ever-changing landscape, you need technology that can keep up. The right tools transform your financial data into useful reports, strategic spending, and actionable insights, but to keep up, you’ll need to build the right tech stack for your needs.

There’s certainly no shortage of options. For every finance function, there’s a dozen corresponding finance technology solutions, and it’s up to you to figure out which one will work best. Here is what you’ll want to consider.

Start With a Strong Foundation

A technology stack is software and tech solutions layered on top of each other to give you the best chance of business success. The foundation of your technology stack is your enterprise resource planning tool (ERP). There are several ERP options available, some extremely industry-specific and others generic enough to be used by any business for any purpose.

Whether a generic or industry-specific ERP is better for your organization, you’ll want to be sure the ERP you choose provides at least the following functions for your business:

- Accounting and financial management

- Customer relationship management (CRM)

- Human resources (HR)

- Inventory management

- Supply chain management

- Project management

Once you’ve chosen an ERP to be the foundation of your financial technology stack – whether that’s Oracle, Microsoft, SAP, or something else – it’s time to start layering the other solutions you’ll add to your stack.

Increase Agility With Financial Reporting Software

Most ERP solutions were built to collect data, not to report on it. You can complete your regular financial reporting using the built-in accounting features in your ERP, but it will take time – time that could be spent on analysis rather than data processing. Adding a dedicated financial reporting software solution such as Spreadsheet Server to your tech stack will make your life a lot easier.

Because most ERPs’ native accounting tools lack agility, completing your regular reporting requires manually pulling data from the ERP into static Excel spreadsheets. This often requires help from IT and working with numbers that are already out of date by the time you’ve got them loaded and formatted in your spreadsheet. It is a time-consuming and tedious process that can often prevent your team from focusing on the deeper analysis and strategic guidance that your business relies on you to provide.

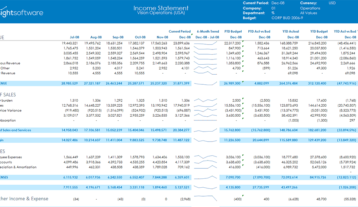

Financial reporting software is far more agile, pulling live data from your ERP for real-time financial and operational reporting. Spreadsheet Server in particular works directly in Excel, allowing you to eliminate manual processes and enable efficient reporting across multiple data sources for shorter month-ends and faster refreshes with ad hoc inquiries and drill downs.

Enhance Your Operational Reporting Needs with Angles for Oracle (APAC)

Download NowMake It Scalable with Budgeting & Planning Software

While it’s true that your ERP will be able to handle some accounting and financial management tasks for you, it can’t do everything. To successfully manage the growth of your business over time, you’ll need a way to effectively plan and budget for many scenarios, and the best way to do that is to add a budgeting and planning software like Bizview to your tech stack.

Software solutions like Bizview give you a level of control over your budgeting, planning, and forecasting processes that you can’t have using just your ERP. You’re able to shorten reporting cycles by automatically combining plan and actual data in one report to accelerate time-critical processes, such as period end closing or budget vs. actual reporting.

In addition, you can speed up variance analysis by drilling down into granular data at the transaction level to provide more accurate reforecasting. You can also produce more detailed planning by creating reports that automatically track financial and operational plans for a deeper understanding and analysis of the plan-to-actual process, without requiring intervention from your IT team.

Simply put, including budgeting and planning software in your financial technology stack puts you in the best position to plan and scale your business growth over time.

Assess Your Needs & Stack Additional Tech as Appropriate

As you grow and scale, you may find that your financial technology stack needs to grow as well. When deciding on the next solutions to add to your stack, consider your pain points. From data analytics to disclosure management to tax reporting, when your organization has a function that isn’t scaling with the rest of the business, there are solutions to help get every function growing at the same pace.

When researched and implemented, financial technology can give your organization the tools it needs to boost the speed, efficiency, and strategic function of your financial processes and data. Understanding your company’s needs and selecting tools that can adapt to meet those needs as they change can help you stack the deck in your favor.