Variance and significance in large-scale online services

The Unofficial Google Data Science Blog

JANUARY 14, 2016

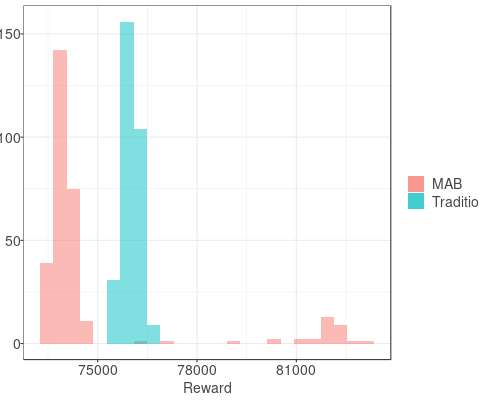

Unlike experimentation in some other areas, LSOS experiments present a surprising challenge to statisticians — even though we operate in the realm of “big data”, the statistical uncertainty in our experiments can be substantial. We must therefore maintain statistical rigor in quantifying experimental uncertainty.

Let's personalize your content