How to Gain Greater Confidence in your Climate Risk Models

Cloudera

OCTOBER 20, 2021

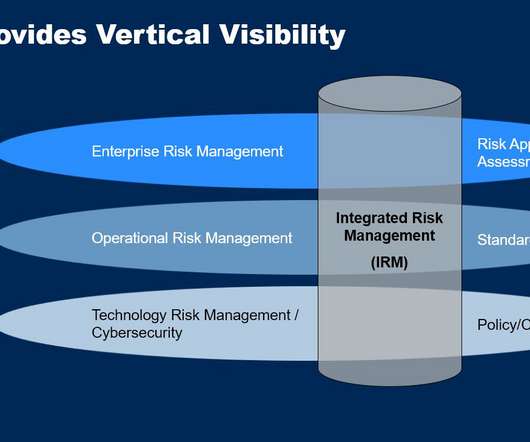

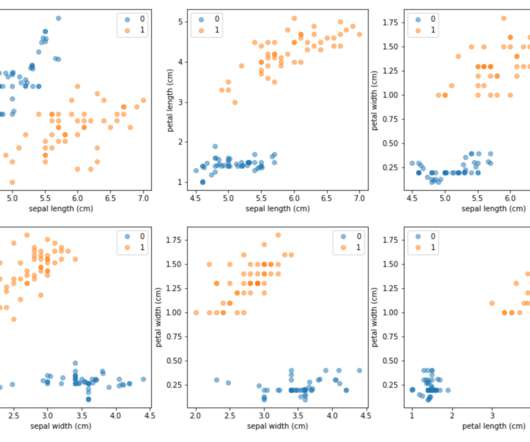

As part of these efforts, disclosure requirements will mandate that firms provide “the impact of a company’s activities on the environment and society, as well as the business and financial risks faced by a company due to its sustainability exposures.” What are the key climate risk measurements and impacts? Generate Scenarios.

Let's personalize your content